China is the world's largest producer of vaccines for human use. According to the data disclosed by the China Procuratorate, China has issued 500 million to 1 billion bottles of vaccines each year, ranking first in the world. From 2012 to 2015, due to the lack of domestic heavy-weight varieties, the vaccine output value has remained at around 15 billion yuan, and the industry's growth has stalled.

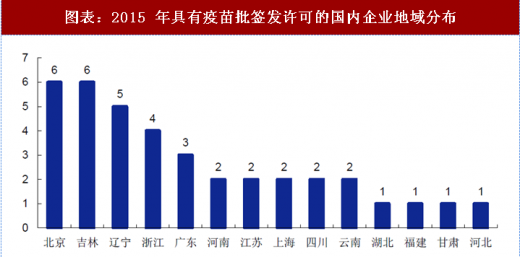

According to data disclosed by the China Prosecutor's Office, there were a total of 43 domestic enterprises with vaccine approval in 2015. Among them, there are 5 foreign companies and 38 local companies (7 subsidiaries of China Biotechnology Corporation and 31 other domestic companies). The 38 domestic enterprises are distributed in 14 provinces / municipalities according to the factory site. Among them, among the other domestic manufacturers with approvals issued in addition to Zhongsheng, more than half of the enterprises can only produce one product. From 2012 to 2015, the number of enterprises that can produce more than three products has grown, accounting for 20% of the growth. To 36%.

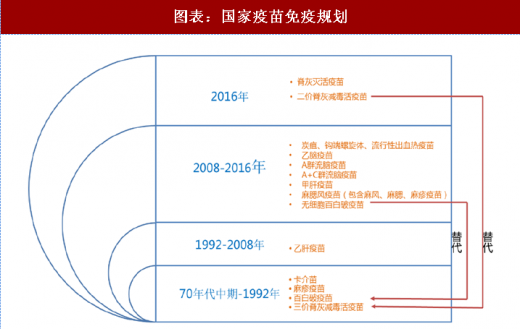

After being supplemented three times in 1992, 2008 and 2016, there are 14 types of BCG vaccine, babaibai, and hepatitis B vaccine, with coverage rates exceeding 90%. In addition, due to the outbreak of avian influenza, the country temporarily listed the H1N1 vaccine as a category 1 vaccine in 2009. The first-class vaccine manufacturers are mainly state-owned enterprises, such as Zhongsheng Group.

The domestic vaccine market is still dominated by first-class vaccines, but its share has been declining year by year. The first-class vaccine market is mainly dominated by state-owned enterprises (six major institutes + Kunming Institute). In 2015, state-owned enterprises accounted for about 79% of the first-class vaccine market, and first-class vaccines accounted for 59% of the total vaccine market. The second-class vaccine market is mainly dominated by private companies. In 2015, the overall market accounted for about 41%, showing a year-on-year growth trend.

It can be seen from the top 20 domestic vaccine vaccine varieties in 2017 that, on the one hand, the newly launched new vaccines and multivalent multi-unit vaccines have delayed the pace of volume increase due to the short time to market and the impact of the 16-year Shandong vaccine event. List, but it is expected to enter a rapid volume increase stage since 2018, which will bring an increase to the second-class vaccine market; on the other hand, the market scale of rabies vaccines, influenza virus split vaccines, oral rotavirus vaccines, etc. is huge. After the release of products such as human diploid rabies vaccine and pentavalent oral rotavirus vaccine, there is a large space for replacement of the existing stock market. Therefore, driven by the above two factors, China's second-class seedling market will rejuvenate and enter the golden development period in the next few years.