The last week of April every year is World Immunization Week. WHO announced the theme of 2018 World Immunization Week is "Vaccination, Common Disease Prevention" (Protected Together, #VaccinesWork), encouraging from donors to the general public for higher interests Consider to make further efforts to improve immunization coverage. Immunization can save countless lives and is recognized as one of the most successful and cost-effective health interventions. It plays an important role in preventing and treating certain infectious diseases, suppressing antimicrobial resistance, and enhancing public health and public health. effect.

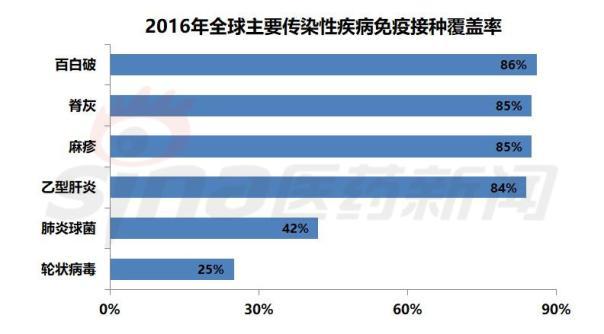

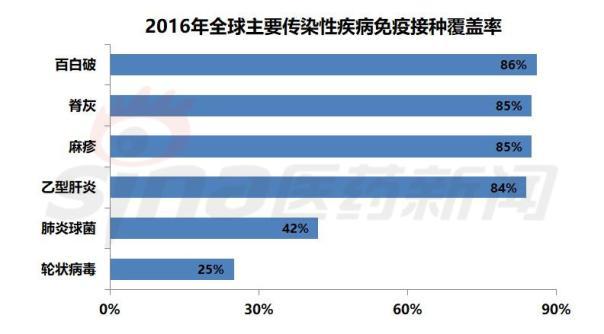

Immunization can prevent diphtheria, hepatitis B, measles, whooping cough, pneumonia, polio, rubella, tetanus and other diseases, and reduce the possible disability and death caused by the disease. Vaccines against the above diseases have been introduced in most countries around the world, and most of the vaccines belong to the routine immunization plan. Infants and young children are the main targets of the global immunization program. WHO data shows that in 2016, approximately 86% of infants and young children (116.5 million) received three doses of Baibaibai triple vaccine in the world. Despite this, there are still more than 19 million children in the world who are not vaccinated or under-vaccinated and face a serious risk of fatal diseases.

2018 is the 40th anniversary of China's implementation of the immunization planning policy. April 25 this year is the 32nd "National Child Vaccination Day". The theme of the promotion is "vaccination, guarding life".

The newly revised “Administration Regulations on Vaccine Circulation and Vaccination” in 2016 clearly pointed out that China ’s vaccines are divided into two categories: the first category of vaccines refers to the government provides free to citizens, citizens should be in accordance with government regulations to receive the vaccine, including national immunization The vaccines determined in the plan, the vaccines added by the people's governments of provinces, autonomous regions and municipalities directly under the Central Government, and the vaccines used in emergency vaccination or group vaccination organized by the people's governments at or above the county level or their health authorities; Class II Vaccines refer to other vaccines that are voluntarily received by citizens at their own expense.

First class vaccine

The conventional vaccines currently included in the national immunization program mainly include BCG vaccine, live attenuated polio vaccine / inactivated vaccine, cell-free Baibaibai combined vaccine (including Baibai combined vaccine), measles (including leprosy vaccine), and leprosy. Vaccines (including gill vaccine), live attenuated JE vaccine / inactivated vaccine, group A meningococcal polysaccharide vaccine, group A + C group meningococcal polysaccharide vaccine, hepatitis B vaccine, live attenuated hepatitis A vaccine / inactivated vaccine, etc. The vaccine packaging has the words "free" and a special logo for "immunization program".

Type 2 vaccine

Such as chickenpox vaccine, pneumonia vaccine, influenza vaccine, oral rotavirus live vaccine, Haemophilus influenzae type b vaccine, HPV vaccine, etc., can be voluntarily vaccinated according to the actual situation at their own expense.

According to the data of the 2017 Annual Report on the Batch Issuance of Biological Products issued by the China Procuratorate, the China Procuratorate and seven provincial drug inspection agencies (Beijing, Shanghai, Guangdong, Sichuan, Hubei, Gansu and Jilin) authorized to undertake the issuance of biological products A total of 4,388 batches (approximately 712 million people) of vaccine products in compliance with the regulations were issued. Among them, 39 domestic enterprises applied for vaccine batch issuance, 4237 batches of domestic vaccines were issued, about 694 million people; 6 overseas companies issued 151 batches of imported vaccines, about 18 million people. In 2017, there were 20 varieties of first-class vaccines issued, about 561 million people, accounting for 78.79% of the marketed vaccines; there were 34 types of second-class vaccines issued, about 151 million people. State-owned enterprises are still the main suppliers of a class of vaccines.

The first-class vaccines in China are mainly borne by the national finances and produced by the domestic "six major institutes of research". Historically, they have been enforced through unified procurement and free supply. They carry more social welfare characteristics and present obvious low-profit and monopolistic characteristics. Only a small number of private enterprises and foreign companies supply hepatitis B vaccine, hepatitis A vaccine and meningococcal vaccine. The second-class vaccines tend to have higher marketization levels, prices, and gross profit margins. They are typical innovation-driven products, and most of the vaccines supplied by foreign companies in China belong to the second-class vaccines. In recent years, China also has strong strengths. Private enterprises are committed to the development and sale of new type 2 vaccines.

At present, the public's limited understanding of certain types of vaccines has made the penetration rate of second-class vaccines and adult vaccination rates in China low. In addition, the recent hepatitis B vaccine incident and the Shandong vaccine incident have also adversely affected China's vaccine industry. . However, with the promotion of people's health awareness, the improvement of domestic product development and production levels, and related favorable policies, there is still great potential for the development of China's vaccine industry.

Newborns and children are the main body of vaccine use in China. The vaccine market capacity is highly positively related to the growth of the number of newborns and children. At present, China ’s comprehensively liberalized second-child policy will directly increase the rigid demand for vaccine products. In 2016, the number of newborns in China has exceeded 17 million. In addition to the mandatory mandatory immunization of first-class vaccines for all newborns, parents will also choose to receive second-class vaccines at their own expense. The demand for first-class and second-class vaccines will expand.

From the end of 2017 to the beginning of 2018, the flu epidemic in China has made influenza vaccination a hot topic, and as our people's awareness of prevention and health care has increased, the future includes influenza vaccine, human papillomavirus (HPV) vaccine, rotavirus vaccine, EV71 Disease vaccines and other second-class vaccines will usher in a period of market development.

WHO pre-certified vaccine products can enter the procurement catalogs of United Nations Children ’s Fund (UNICEF), Global Vaccine Alliance and other procurement organizations and other NGOs. As of January 2018, a total of four vaccine products in China have passed the WHO pre-certification, which are the live attenuated Japanese encephalitis vaccine of Zhongcheng Capital Company, the influenza vaccine of Hualan Biotechnology, the bOPV vaccine of Zhongsheng Beishengyan, and Kexing. Biological hepatitis A vaccine. Passing WHO pre-certification indicates that the quality of domestic vaccines has reached the corresponding international standards, which is conducive to expanding China's vaccine export volume, promoting products to enter overseas markets, and driving the transformation and upgrading of China's vaccine industry.

In recent years, the global epidemic caused by new influenza viruses, Ebola virus, Zika virus and other outbreaks have made the demand for new vaccines more urgent; at the same time, global polio, measles, tuberculosis, etc., including China Infectious diseases have shown signs of resurgence, and other infectious disease viruses have accumulated a large number of genetic mutations, and the corresponding vaccine products are urgently needed to be updated. If domestic vaccine companies with strong R & D and innovation capabilities can accelerate R & D efficiency and seize opportunities, they will have huge room for development.

The vaccine industry is a high-tech barrier industry. Under the influence of multiple favorable factors, China's stronger vaccine companies have accelerated their pace of innovation. There are already a number of heavy vaccine varieties that are worthy of attention and are in the state of research and development or market.

HPV vaccine

At present, there are two types of HPV vaccines approved for listing in China. They are: approved in 2016, a bivalent human papillomavirus adsorption vaccine produced by GSK, trade name CERVARIX; approved in 2017, produced by MSD Tetravalent human papillomavirus vaccine (Saccharomyces cerevisiae), trade name GARDASIL. Although the two currently approved HPV vaccines are both imported products, many domestic pharmaceutical companies have already deployed this field. Watson Bio's 2-valent HPV vaccine is currently in the final stage of a phase III clinical trial and is expected to become the first domestically-available domestic variety. The company's holding subsidiary Shanghai Zerun Bio's 9-valent HPV vaccine was also obtained in early 2018 Approval for clinical trials. In addition, Xiamen Wantai and Bowei Biotech have also obtained clinical trial approvals for the 9-valent HPV vaccine, and MSD's 9-valent HPV vaccine has been submitted for marketing application on April 20. It is worth noting that when Premier Li Keqiang inspected the drug supply and price in Shanghai on April 11, he specifically instructed that the relevant departments must speed up the examination and approval, ensure the supply, and let the interested people get the latest HPV and other anti-cancer vaccines as soon as possible.

Pneumonia vaccine

China's approved pneumonia vaccines are only 23-valent pneumococcal polysaccharide vaccine and 13-valent pneumococcal polysaccharide combined vaccine. Among them, the 23-valent pneumococcal polysaccharide vaccine is suitable for children over 2 years old and high-risk adults, and the 13-valent pneumococcal polysaccharide vaccine is suitable for children under 2 years old.

The approved enterprises of 23-valent pneumococcal polysaccharide vaccine include SANOFI PASTEUR, MSD, Chengdu Institute of Biological Products and Watson Bio. This product of Watson Bio is the world's first 23-valent pneumococcal polysaccharide vaccine without preservatives. . For domestic research companies, the products of Kangtai Biotech and Kexing Biotech are currently in the final approval stage before being listed, and the products of Changsheng Biotech and other companies are in clinical trial.

Pfizer's Peier 13 is the only 13-valent pneumococcal polysaccharide conjugate vaccine product approved for marketing in China. This vaccine is also the only vaccine product that has entered the global "bullet bomb" club and is the exclusive product of Pfizer. At present, Kangtai Minhai, Watson Bio, Kexing Bio, and Lanzhou Institute of Biological Products are the main competitors in the research and development of 13-valent pneumococcal polysaccharide conjugate vaccines in China. Among them, Watson Bio has ended clinical trials and entered the listing and declaration stage. Other companies are still in clinical trials.

Combined vaccine

The combined vaccine can prevent more kinds of diseases while reducing the number of vaccine injections. It can not only reduce the pain caused by multiple injections to babies and parents, reduce the difficulty of vaccine management and vaccination costs, but also reduce the need for vaccine production. Containing preservatives and adjuvants and other doses to reduce the adverse reactions of the vaccine is the trend and direction of upgrading and upgrading of traditional vaccine products in the future. Most of the combined vaccines marketed in China are based on the DPT vaccine. The most common antigen is the combination of SANOFI PASTEUR's adsorbed cell-free DTP and combined Haemophilus influenzae type b (combined) vaccine. Listed Wulian Miao. Minhai Biological's cell-free H. influenzae type b combination vaccine, Wuhan Institute of Biological Products' adsorbed pertussis diphtheria tetanus hepatitis B combination vaccine, and Zhifei's AC group meningococcal (combined) type b influenza The Haemophilus (combination) combination vaccine is a representative domestic combination vaccine. At present, many domestic companies are focusing on the research and development of poly vaccines, hoping to narrow the gap with imported poly vaccine products in the near future.

Seasonal flu vaccine

Except for individual vaccines targeting specific influenza subtypes, the seasonal influenza vaccines currently used in China are all recommended by the WHO trivalent vaccine in the northern hemisphere, but their vaccination rate in China is low. The quadrivalent influenza vaccine with wider coverage, stronger protection and more recommended by WHO has been launched abroad, but it has not yet entered our country. From the end of 2017 to the beginning of 2018, China's influenza epidemic has greatly improved people's awareness of influenza vaccines. In addition to the recent trend of B / Yamagata (BY) strains and the upgrading of vaccine products, domestic influenza vaccine manufacturers have focused on Application for research and development of quadrivalent influenza vaccine. Among them, the fastest application is Changsheng Biology and Hualan Biology. At present, the quadrivalent influenza vaccines declared by the two companies have completed technical reviews including pharmacology, toxicology, clinical and pharmacy. It is expected that soon Will be approved for listing.

In addition to the above varieties, Sabin strain inactivated polio vaccine (Vero cells), enterovirus type 71 vaccine (ie hand, foot and mouth disease vaccine), rotavirus vaccine, herpes zoster vaccine, norovirus vaccine, etc. are currently The key vaccine varieties worthy of attention.

In recent years, there have been many heavy vaccine varieties approved for market in China, and it is expected that the market competition situation of China's vaccine products will become more intense in the future. More and more companies have shifted their focus of development to the upgrading of traditional vaccine products and the field of new vaccines. At the same time, they have focused on improving the quality and speed of vaccine research and development in order to occupy the commanding heights of the market. It is believed that under the influence of various favorable factors such as the continuous enhancement of China's vaccine research and development and production strength, and the in-depth reform of the drug review and approval system, more, more effective, and safer vaccines will be approved for marketing, better reflecting the improvement of vaccines. The important role and value of the health level of our people.